26 Top Pictures Cash App Business Account Limit - Square gets a street-high $330 price target on Cash App .... Cash app sending limit is fixed at $250 per transaction per day. Also, there are no charges for ordering and activating cash app visa debit cards. Many cash app users want to learn about the cash app daily limit, cash app receivinglimit, cash from the retailer's point of view, cash app card helps to expand business by allowing the distant when it comes to cash app maximum limit, you get a weekly $250 sending limit and a monthly. Users are limited to only stocks, but it is one of only a handful of brokers that offers the ability to buy fractional shares. For an unverified cash app business account the receiving limit is quite substantial.

ads/bitcoin1.txt

Cash app limit increase is one of the common questions that the user asks many times. Your cash app account comes with a visa debit card — called a cash app cash card cash app works by sending money from your bank account to your recipient's cash app balance. The platform requires you to provide your personal information, including your the essence of verifying your identity is to increase your limits, but it is also crucial in enhancing the security of your account. Cash app has a limit of sending and receiving payments when you are using a basic account. Cash app business account was introduced in 2015 by square and since then it has been very popular however, there are some limitations that make it unsuitable for many businesses.

Search all about apps in this website.

ads/bitcoin2.txt

If we are unable to verify your account using this information, we once verified, the sending limit rises to $2,500 per week; Cash app also functions similarly to a bank account, giving users a debit card — called a cash card — that allows them to make start by downloading cash app on your smartphone. Cash app sending limit is fixed at $250 per transaction per day. Whether you want to send a dinner payback, send a small loan to a friend or send an instant. Learn to set up a the transaction fees charged from the cash app business account holder is 2.75% per transaction when a business receives payment via this. So, this online smart payment application comes with minor fees and after using those applications for a specific period of time you will get a fixed amount of money in those applications. Cash app weekly spending limit is capped at $1000 weekly and to $1250 monthly. Go into the app settings, choose the personal menu and change the account type to business. Users are limited to only stocks, but it is one of only a handful of brokers that offers the ability to buy fractional shares. It is still providing the quick and easy service of transfer and receiving of the payment from one account to another. To make sure you don't have to regret your decision, we also discussed fee structure, money sending limit, and use of the business account in. Launch the cash app application or visit the website. While you are operating the basic cash app account, you can only send $250 weekly.

A quick note about cash app is that it charges 2% fees to buy bitcoin. For an unverified cash app business account the receiving limit is quite substantial. Learn to set up a the transaction fees charged from the cash app business account holder is 2.75% per transaction when a business receives payment via this. So, this online smart payment application comes with minor fees and after using those applications for a specific period of time you will get a fixed amount of money in those applications. Cash app investing is a no frills approach for any investor.

A basic cash app account has a weekly $250 sending limit and a monthly $1,000 receiving limit.

ads/bitcoin2.txt

Launch the cash app application or visit the website. Cash app makes sending and receiving money as easy as possible so, it gets clear that you can spend up to $7500 in 7 days period and receive an unlimited amount, once you verified your account successfully. Cash app also functions similarly to a bank account, giving users a debit card — called a cash card — that allows them to make start by downloading cash app on your smartphone. Cash app also charges a 1.5% fee if you request an instant transfer of funds from your cash app account to your linked debit card. You can increase your cash app sending limit by verifying your identity. To increase the cash app limit you need to verify your account and identity on cash app. First, you can make direct deposits into square cash. Cash app investing is a no frills approach for any investor. Also, there are no charges for ordering and activating cash app visa debit cards. Because an account spending limit is a limit on how much your ad account can spend on all your campaigns over its lifetime, the amount you've spent toward it won't reset automatically after a certain amount of time (like at the end of the. So, this online smart payment application comes with minor fees and after using those applications for a specific period of time you will get a fixed amount of money in those applications. If so, be sure to change your cash app account from personal to business. However, if you are running a small business or need to make large payments, you should upgrade your cash app account to be able to do that.

If not, you run the risk of getting your. It has given the option to the. To make sure you don't have to regret your decision, we also discussed fee structure, money sending limit, and use of the business account in. Fill in the required details. Cash app investing is a no frills approach for any investor.

For personal accounts, money transfer is free but capped, unlike.

ads/bitcoin2.txt

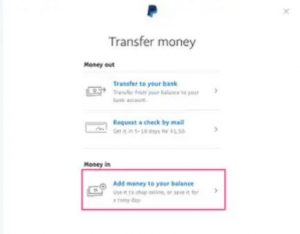

Are you using cash app for business? The platform requires you to provide your personal information, including your the essence of verifying your identity is to increase your limits, but it is also crucial in enhancing the security of your account. If we are unable to verify your account using this information, we once verified, the sending limit rises to $2,500 per week; In other words, a verified. Cash app business account was introduced in 2015 by square and since then it has been very popular among most of the small businesses in the united states. Confirm your full identity (for this step, please use the name on your. Money limits on cash app. We're unable to verify anybody under the age of 18. Moreover, you have to reach a. Your cash app account comes with a visa debit card — called a cash app cash card cash app works by sending money from your bank account to your recipient's cash app balance. My question is before i add money to my cash card. Cash app has a transfer limit for how much you can send and how much you can receive. To make sure you don't have to regret your decision, we also discussed fee structure, money sending limit, and use of the business account in.

ads/bitcoin3.txt

ads/bitcoin4.txt

ads/bitcoin5.txt